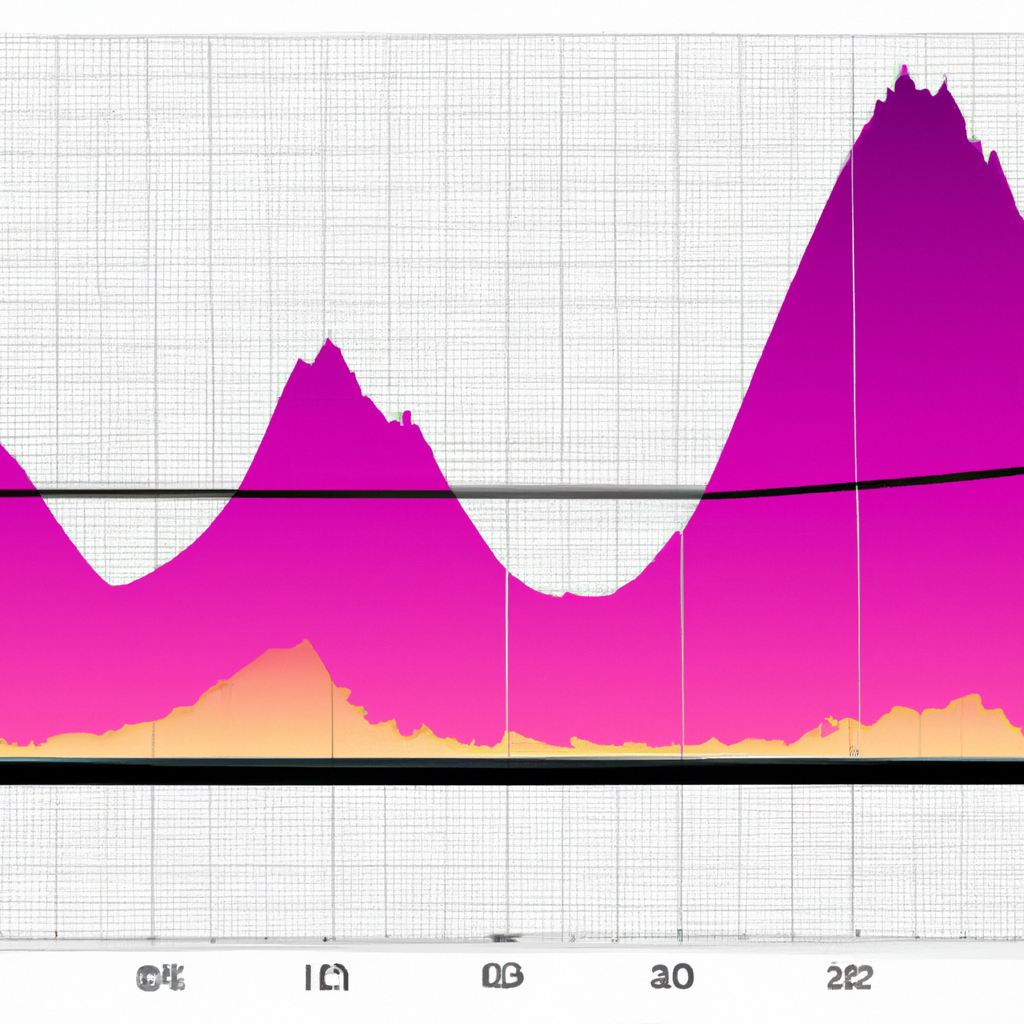

MACD Histogram Interpretations

The Moving Average Convergence Divergence (MACD) histogram is a popular technical analysis tool used by traders to identify potential buy or sell signals in the financial markets. It is derived from the MACD indicator, which is calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA. The MACD histogram represents the difference between the MACD line and the signal line, which is a 9-day EMA of the MACD line.

Interpretation of Positive MACD Histogram

A positive MACD histogram suggests that the MACD line is above the signal line, indicating bullish momentum in the market. This interpretation can be further categorized into two scenarios:

- Increasing Positive Histogram: When the MACD histogram bars are getting taller and moving towards the upside, it indicates that the bullish momentum is strengthening. Traders may consider this as a potential signal to buy or hold their positions.

- Decreasing Positive Histogram: If the MACD histogram bars start to decrease in height and move towards the zero line, it suggests that the bullish momentum is weakening. Traders may interpret this as a signal to be cautious and consider taking profits or tightening stop-loss levels.

Interpretation of Negative MACD Histogram

A negative MACD histogram indicates that the MACD line is below the signal line, signaling bearish momentum in the market. Similar to positive histograms, negative histograms can also be interpreted in two ways:

- Increasing Negative Histogram: When the MACD histogram bars are getting taller and moving towards the downside, it suggests that the bearish momentum is strengthening. Traders may view this as a potential signal to sell or hold short positions.

- Decreasing Negative Histogram: If the MACD histogram bars start to decrease in height and move towards the zero line, it indicates that the bearish momentum is losing strength. Traders may interpret this as a signal to be cautious and consider covering short positions or tightening stop-loss levels.

Interpretation of Zero Line Crossovers

Another important aspect of MACD histogram interpretation is the zero line crossover. A zero line crossover occurs when the MACD histogram crosses above or below the zero line. This crossover can provide valuable insights into potential trend reversals:

- Bullish Zero Line Crossover: When the MACD histogram crosses above the zero line from negative territory, it suggests a shift from bearish to bullish momentum. Traders may interpret this as a signal to enter long positions or close out short positions.

- Bearish Zero Line Crossover: Conversely, when the MACD histogram crosses below the zero line from positive territory, it indicates a shift from bullish to bearish momentum. Traders may view this as a signal to enter short positions or close out long positions.

Conclusion

The MACD histogram is a versatile tool that can help traders identify potential buy or sell signals in the financial markets. By understanding the interpretations of positive and negative histograms, as well as zero line crossovers, traders can make more informed decisions and improve their trading strategies. However, it is important to note that the MACD histogram should be used in conjunction with other technical indicators and analysis techniques to validate trading signals and reduce the risk of false signals.