Understanding the MACD Histogram

The Moving Average Convergence Divergence (MACD) Histogram is a powerful tool used by traders and investors to gauge market momentum and potentially forecast future price movements. Developed by Gerald Appel in the late 1970s, the MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD Histogram, an integral component of the MACD, takes this analysis further by measuring the distance between the MACD line and the signal line.

Components of the MACD Indicator

Before diving into the MACD Histogram, it’s essential to understand the components that constitute the MACD indicator itself. The MACD consists of three main components:

– The MACD Line: The difference between the 12-day Exponential Moving Average (EMA) and the 26-day EMA.

– The Signal Line: The 9-day EMA of the MACD Line.

– The Histogram: The difference between the MACD Line and the Signal Line.

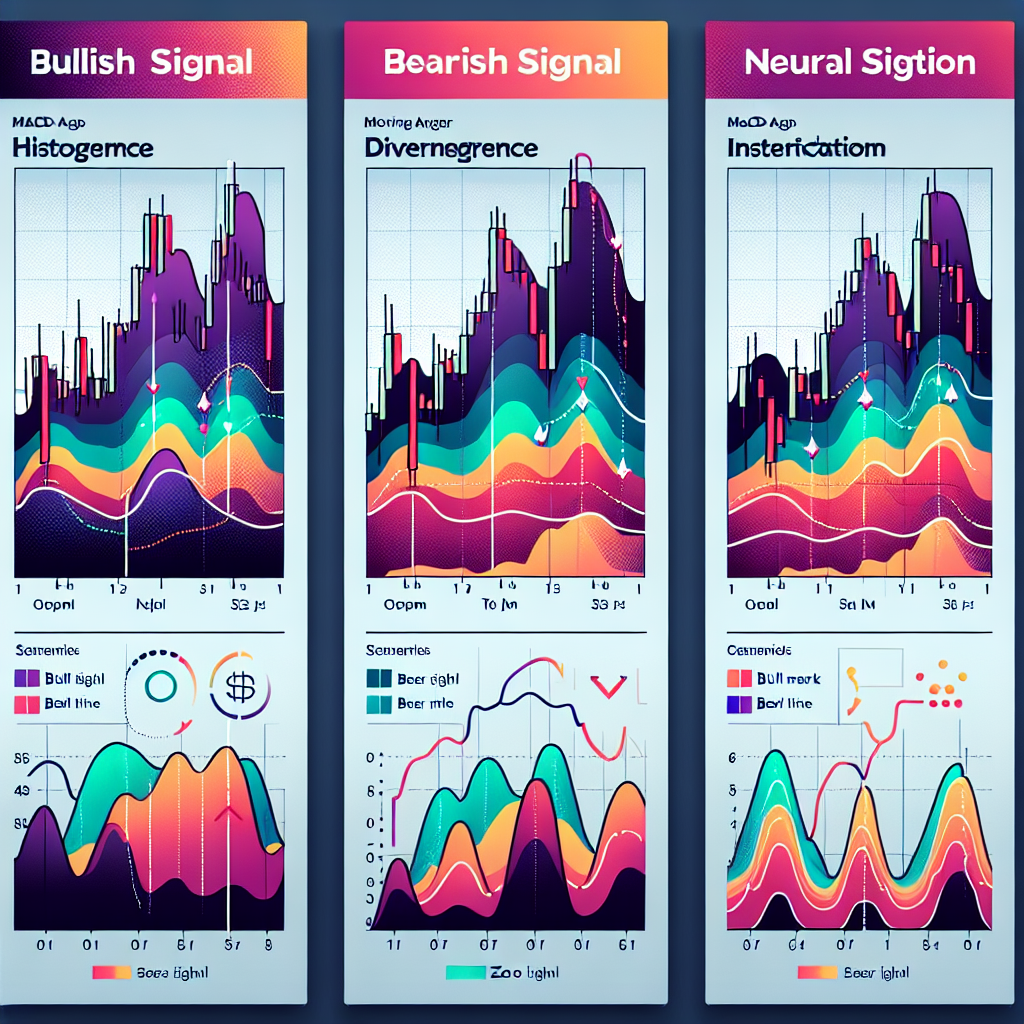

How to Interpret the MACD Histogram

The MACD Histogram is a visual representation of the difference between the MACD line and its signal line. It is plotted as bars on a chart, where the height and direction of the bar indicate the strength and direction of the trend.

Zero Line Crosses

The most basic and critical signal from the MACD Histogram is when it crosses the zero line.

– A movement from below to above the zero line indicates bullish momentum, suggesting it might be a good time to consider buying.

– Conversely, a movement from above to below the zero line indicates bearish momentum, potentially signaling a good time to sell or short.

Bullish and Bearish Divergences

Another powerful aspect of the MACD Histogram is its ability to show divergences from price action, which can signal potential reversals.

– Bullish Divergence: Occurs when the price records a lower low, but the MACD Histogram makes a higher low. This situation suggests that the downside momentum is weakening, and an upward price reversal could be imminent.

– Bearish Divergence: Occurs when the price achieves a higher high, but the MACD Histogram plots a lower high, indicating weakening upward momentum and a potential downward price reversal.

Increasing and Decreasing Bars

The length of the MACD Histogram bars also provides insight into market momentum.

– Increasing bars, whether above or below the zero line, indicate strengthening momentum in the direction of the current trend.

– Decreasing bars suggest weakening momentum and could precede a trend reversal or consolidation period.

Practical Tips for Using the MACD Histogram

To effectively utilize the MACD Histogram in trading, consider the following best practices.

Confirmation is Key

Always look for additional signals to confirm Histogram indications. No single indicator should be used in isolation for trading decisions. Combine the MACD Histogram with support and resistance levels, price patterns, or other indicators.

Be Wary of False Signals

Like all trading tools, the MACD Histogram is not foolproof and can generate false signals, especially in volatile or sideways markets. Always set stop-loss orders to manage your risk effectively.

Adjust Settings to Fit Your Strategy

While the default settings (12,26,9) are a good starting point, you might find that adjusting the parameters better suits your trading strategy or the specific market you are trading.

Practice Makes Perfect

Before applying the MACD Histogram to real trading scenarios, practice interpreting its signals in a demo account. This practice will help you become familiar with the indicator’s nuances and how it reacts to different market conditions.

Conclusion

The MACD Histogram is a versatile tool that, when used correctly, can significantly enhance your market analysis and trading strategy. By understanding how to interpret its signals and integrating it with other analytic tools and risk management strategies, you can potentially increase your trading efficacy and make more informed decisions in the markets.