Elliott Wave Theory Application: A Comprehensive Guide

Introduction

The Elliott Wave Theory is a popular technical analysis tool used by traders and investors to forecast market trends. Developed by Ralph Nelson Elliott in the 1930s, this theory is based on the idea that financial markets move in repetitive patterns, which can be identified and analyzed to predict future price movements.

Understanding the Elliott Wave Theory

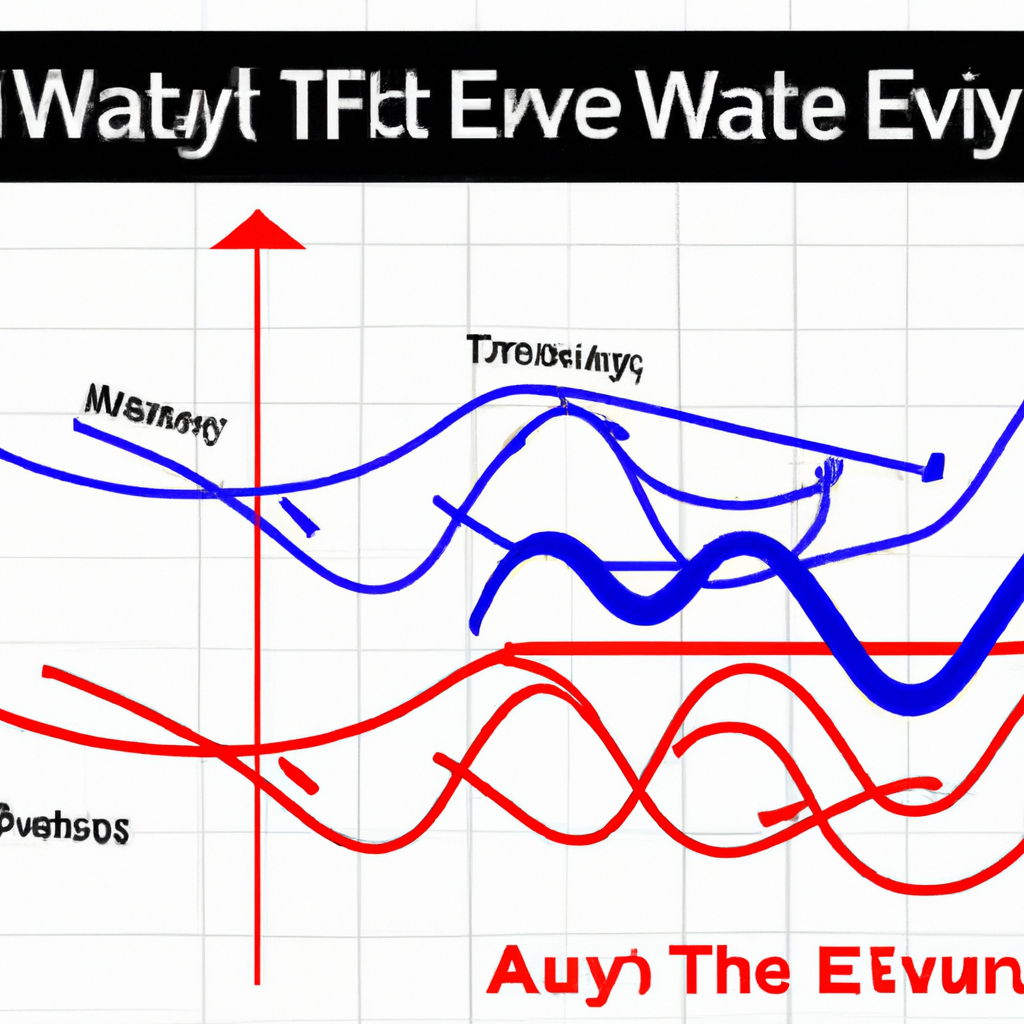

The Elliott Wave Theory is based on the concept that market movements are driven by a combination of two types of waves: impulse waves and corrective waves. Impulse waves move in the direction of the main trend and consist of five smaller waves, labeled 1, 2, 3, 4, and 5. Corrective waves, on the other hand, move against the main trend and consist of three smaller waves, labeled A, B, and C.

Identifying Wave Patterns

To apply the Elliott Wave Theory, traders need to be able to identify wave patterns on price charts. The most common wave pattern is the five-wave impulse pattern, which is followed by a three-wave corrective pattern. Traders can use various technical analysis tools, such as trendlines, moving averages, and Fibonacci retracements, to identify these patterns.

Applying Fibonacci Ratios

Fibonacci ratios play a crucial role in the Elliott Wave Theory. The most commonly used Fibonacci ratios in this context are 0.618, 0.382, and 1.618. These ratios help traders determine potential price targets for wave extensions and retracements. By applying Fibonacci retracements to the previous wave, traders can identify levels where the price is likely to reverse or continue in the direction of the trend.

Using Elliott Wave Oscillators

Elliott Wave Oscillators are technical indicators that help traders confirm the validity of wave patterns. These indicators calculate the difference between two moving averages of the price and display it as a histogram. By analyzing the histogram’s movements, traders can determine whether the market is in an uptrend or a downtrend and identify potential entry and exit points.

Applying Elliott Wave Theory in Practice

Once traders have identified wave patterns and potential price targets, they can use this information to make trading decisions. For example, if a trader identifies an impulse wave in an uptrend, they may decide to enter a long position and set a target price based on Fibonacci extensions. Conversely, if a corrective wave is identified in a downtrend, a trader may consider shorting the market and setting a target price based on Fibonacci retracements.

Limitations of the Elliott Wave Theory

While the Elliott Wave Theory can be a valuable tool for market analysis, it is important to note its limitations. Wave patterns can be subjective, and different analysts may interpret them differently. Additionally, the theory does not provide specific timing for market movements, making it challenging to determine when exactly a wave will begin or end.

Conclusion

The Elliott Wave Theory is a powerful tool that can assist traders and investors in analyzing market trends and making informed trading decisions. By understanding wave patterns, applying Fibonacci ratios, and using oscillators, traders can gain valuable insights into the market’s behavior. However, it is essential to consider the limitations of this theory and combine it with other technical and fundamental analysis tools for a comprehensive market analysis approach.